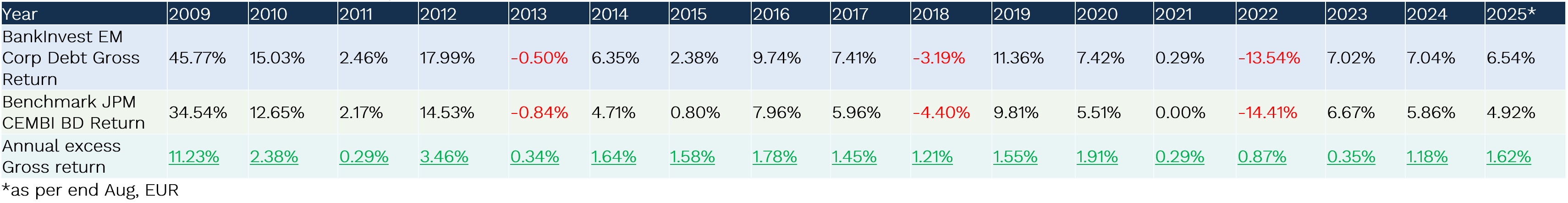

BankInvest Emerging Markets Corporate Debt is an actively managed strategy investing in corporate bonds from issuers in Emerging Markets

Launched in 2009 as one of the world’s first EM corporate bond funds

Continuously managed by the original Portfolio Managers Søren Bertelsen and Chresten Hagelund with over 40 years of combined EMD experience - supported by dedicated EM credit analysts & economists

The strategy combines rigorous country and issuer screening with selective BB/BBB positioning to generate consistent alpha while minimizing downside risk

The strategy is accessible via daily UCITS structures (LUX SICAV) or segregated mandates

The strategy is available in both institutional (I) and retail (R) share classes

* For PRIIP KIDs in other languages - click here

Strategy background

BankInvest has a long-standing presence in Emerging Markets Debt, with the corporate strategy originating in 2001. Chief Portfolio Manager Søren Bertelsen transitioned from EM equity to build a portfolio of hard currency sovereign and corporate debt.

In 2009, Søren and Chresten Hagelund refined the strategy to focus exclusively on Emerging Markets Corporate Debt, anticipating its expansion beyond the current Latin American dominance as demand for dollar funding grew among quality issuers.

The strategy’s longevity, combined with disciplined risk management and ESG integration, has delivered strong excess returns, high alpha, and resilient capital preservation through market cycles.

-

Søren Bertelsen

Chief Portfolio Manager

-

Chresten Hagelund

Senior Portfolio Manager

Investment Philosophy & Process

An Investment Philosophy Built on 3 pillars

- Understanding Market Characteristics:

We aim to uncover potential inefficiencies and under-researched opportunities in the market. - In-Depth Bottom-Up Research:

We allocate significant time and resources to thoroughly research and value the investment universe, going beyond quantitative inputs from models. - Robust Portfolio Construction:

We focus on building a strong portfolio while minimizing downside risk through a comprehensive risk management framework.

Sustainability and ESG Integration

ESG is an integral part of our investment process and within the Emerging Markets universe this is no exception.

In fact, in 2007, BankInvest was the first to launch an Emerging Markets SRI Debt fund for institutional investors: the precursor to today’s ESG nomenclature. Five years later an EM Corporate Debt SRI fund was launched.

This is to prove that we just didn’t jump on the ESG bandwagon when it became trendy. Please find additional details about our Sustainability framework here