Investment Strategy

Emerging Markets Corporate Debt

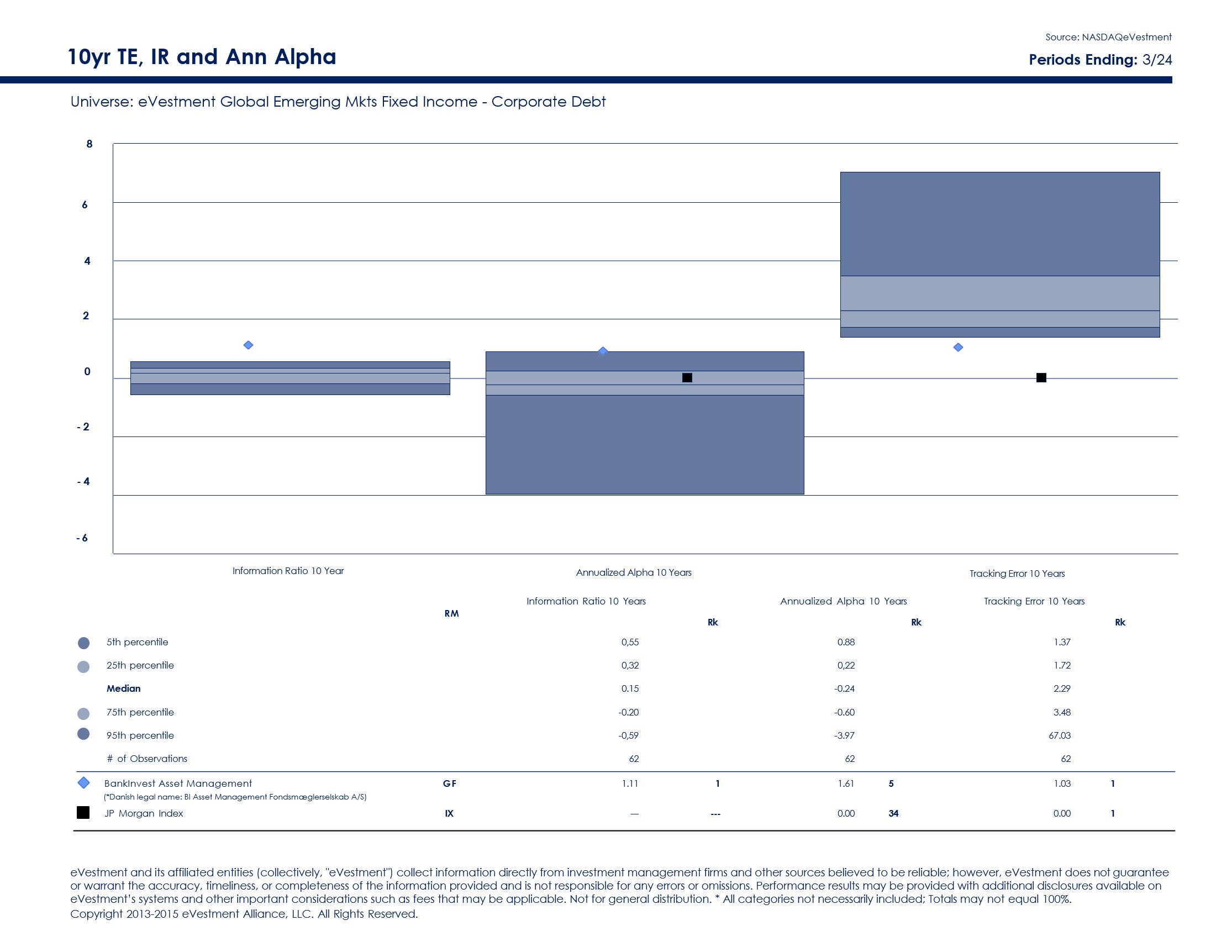

Performance and Track Record

BankInvest has a long track record in Emerging Markets Debt. The current Emerging Markets Corporate Debt strategy has its genesis in 2001 when Chief Portfolio Manager, Søren Bertelsen saw opportunities in this asset class from his work as head of EM equity. Over the next few years, Søren built up a robust portfolio of hard currency emerging markets debt of government and corporate debt.

The latter market was dominated by Latin American issuers and the time, but both Søren and his colleague, Chresten Hagelund, read the tea leaves and realized that the corporate market was set to grow and to break out of its tradition geographical constraints as the demand for dollar funding for well-run emerging corporates was growing. In 2009, the two portfolio managers calibrated the strategy to focus uniquely on Emerging Markets Corporate Debt and they have been with the strategy since its inception.

The longevity of this investment strategy and the focus on risk-management and ESG factors have led to robust excess returns with a well-documented annualized alpha with a high information ratio over the past decade. This consistent track record of stable excess returns across multiple business is predicated upon a rigorous and disciplined focus on the investment process and managing risk factors. This has led to consistent upside capture and strong relative capital preservation in downturns.

Client-Centric Solutions and Customization

Our boutique size allows us to adapt our requirements to meet investor needs. Our owner banks are happy with the UCITS funds we can offer their networks, and our existing SICAVs have attracted European institutional investors. However, many investors would like to apply their own exclusion lists or rating limitations. We have been able to adapt to these demands through segregated mandates and country-specific structures such as KVG with trusted partners in Germany.

Asset Selection

Our investment philosophy takes the disparate nature of the emerging markets universe into account. The name “emerging markets” is itself a misnomer, as it includes developed and wealthy nations ranging from South Korea, Mexico, to Hungary. Primus inter pares is having an understanding of the country of domiciliation in order to minimize downsize risk. If we do not feel comfortable with the country of domiciliation, we do not venture further with corporate issuers from that nation.

Our screening process also includes a strong overview of corporate governance and legal protections in place. We focus on national champions (number one or two in a given country) in the selection process. There may be greater pick up by going for the fourth-largest national issuer in a given sector, say, but the downside can be more pronounced in a market reversal. Bond investors have a long memory, and we look at the track record of how the issuer has treated debt owners and minority shareholders (if not family-owned) in the past. While we do have a bottom-up approach to credit investing, we have developed top-down analytic quant-based tools which not only help us to narrow down the universe but help set up early-warning systems in place for possible negative events such as accounting fraud. Moreover, we prefer listed issuers with strong local investor support. In the Emerging Markets investor universe, many are either absolute or outside of the CEMBI benchmark.

Our long-standing relationships with lead Syndicate desks extend to many of the issuers themselves, most of whom we have met professionally in person or via digital media such as Teams or Zoom. We strive to provide qualitative feedback during the new issue process, which often entails us being wall-crossed in the run up to a new issue process. BankInvest has stringent compliance and regulatory rules towards soft-sounding and wall-crossing in place.

Our smaller size makes us nimble and enables us to navigate easier in the secondary markets compared to bulge bracket peers. This also allows us to focus on individual credits off the beaten track. Moreover, our knowledge and experience allow us the wherewithal to take advantage of attractive buy-opportunities during periods of tourist investor exodus due to various factors such as an issuer downgrade.

BankInvest used to have offices in Mexico City and Singapore which allowed the teams to meet local issuers and investors, however this impeded expeditious investment decision-making due to the difficulties in coordinating across several time zones. Today the portfolio managers and analysts all sit within a few meters’ radius which allows quicker reaction time. Individual asset selection decisions are consensual, and both senior portfolio managers have a veto right in this process.

We see value in the risk/return profile of the BBB and just south of crossover segment of the credit spectrum and place great emphasis on DTS (Duration Times Spread) in our positioning in this segment compared to the relative benchmark.

Sustainability and ESG Integration

ESG is an integral part of the investment process at BankInvest and within the Emerging Markets universe this is no exception. In fact, in 2007, BankInvest was the first to launch an Emerging Markets SRI Debt fund for institutional investors: the precursor to today’s ESG nomenclature. Five years later an EM Corporate Debt SRI fund was launched. This is to prove that we just didn’t jump on the ESG bandwagon when it became trendy.

ESG factors are considered during the entire lifecycle of the investment process. Financial risks stemming from climate related transition have high priority in the ESG analysis (MSCI ESG ratings and Morningstar Sustainalytics assist us in setting the parameters of the investment universe during the idea generation phase. The second overlay consists of macroeconomic analysis which sets clear guidelines for limiting investment in weaker ESG countries. This is also in conjunction with norm-based and sector exclusions such as controversial weapons, coal mining, off-shore Arctic drilling, tar sands production, and production and distribution of tobacco products.

Our qualitative understanding of ESG risks and performance is supported by our direct engagement with both issuers and syndicate desks. We also have developed in-house tools that integrate ESG risk factors and pinpoint trends into our Aladdin management system. These ESG factors, along with SDG contributions and CO2 emissions relative to the benchmark, help us in the process of portfolio construction.

Our ESG and Risk teams at BankInvest are independent from Investments but work very closely with the Portfolio Management team. Their offices are adjacent to one another and there is open dialog and bilateral advisory in the investment decision process. It is not only the portfolio management team, which is accessible to clients, but the ESG team has an increasingly active role in discussing the role of ESG with current and future institutional investors.

Portfolio Managers

-

Søren Bertelsen

Chief Portfolio Manager

-

Chresten Hagelund

Senior Portfolio Manager

Available funds and share classes